Banking and Insurance Industries

Banks and insurers have been in existence for a long time and facilitate economic activities for us. Banking and insurance play essential roles in the economic growth of a country and society. Both institutions provide the essential services of commercial transactions and covering risks.

© Abhishek Singh, Karthik Ramasubramanian, Shrey Shivam 2019

A. Singh et al., Building an Enterprise Chatbot,

https://doi.org/10.1007/978-1-4842-5034-1_1

Insurance services evolved from the practice of risk management for uncertain events. The risk is defined as the uncertainty of outcome in the normal process. The risks are quantified in monetary terms with consequences that are unfavorable to the process. The insurance function tends to manage the risk by providing a security net against a payment. In financial terms, insurance transfers the risk of the unfavorable event to the insurer against a payment of a premium.

As seen in Figure 1-1, the primary function of an insurance company is to manage the fund created by the premiums paid by the insured. The critical function of an insurance company is to measure the risk of loss arising from the pool to decide on premiums and, in case of an accident/ adverse outcome, pay the policyholder the loss amount. As the count of adverse outcomes decreases with an increasing population, smaller premiums can be levied while a higher payout can be made to the insured who faces an adverse outcome.

Figure 1-1. Theoretical framework of insurance

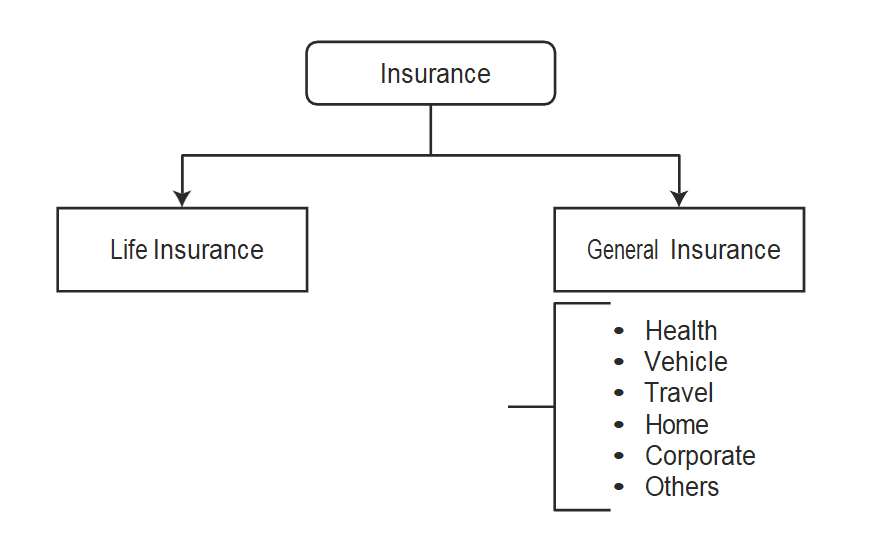

The insurance industry is comprises of evolved financial services and products which are centuries old. With the advent of technology, the insurance industry has seen a surge in number of big insurance companies and deeper penetration with new products. Having a concentration brings better premiums for the insured and allows companies to cover a broader set of risks. As seen in Figure 1-2, typically the insurance products can be divided into two categories: life insurance and general insurance.

Figure 1-2. Insurance product categorization

Life insurance provides coverage to the risk of mortality. The insured beneficiary receives a face amount in case of death during the coverage period. In this manner, this insurance product safeguards against financial losses arising from the death of a critical member of the family. The risk covered is called mortality risk. The actuarial science is the study of mortality behavior and used in study of fair pricing of premiums for the given subject for life insurance.

Insurance is not just limited to insuring against the risk of death. The insurance concept has been extended to other forms of risk as well. The other bucket of coverage is known as general insurance; this includes health insurance covering the financial risk of ill health, vehicle insurance for accidents, travel insurance for flight delays, and so on. The established insurance companies offer multiple products to customers and institutions as per their needs. Some of these products have standard features, where some insurance companies can create custom deals as per client needs, for instance covering the risk of severe weather during a significant event. The key differentiator between a good and bad insurer is how diligently and accurately it can measure the risk involved in the underlying events.

Figure 1-3. Theoretical framework of banking

Lenders have access to capital, such as institutional members having excess cash or a small retail customer who has some savings. The borrower is short of capital, but they have some economic activities which can bring returns on their investment. The bank comes into the play to solve this gap in the financial system and creates an opportunity for the lender to earn interest on deposits and lets the borrower get the required capital for an interest rate. In the example in Figure 1-3, a lender deposits $10,000 into the bank and receives 2% interest (i.e., $200), while the bank lends $10,000 to the borrower at 9% interest (i.e., gaining $900 in the transaction). The spread of 7% (i.e., 900-200=700) is the income for bank, which it can use to run operations and create new products.

Like insurance, banks have also evolved to provide various services for different types of customers and entities. Figure 1-4 is basic classification of types of banks. It is a not an exhaustive list of the types of banks and banking services. However, they are the primary type of banks.

Figure 1-4. Common types of banks

Within the scope of this course, we will point out the typical process for an end customer for accessing financial service. The customer for a retail bank and life insurance company are the same, except for a few cases. This makes it easier to illustrate how insurance company touchpoints with customers are similar to those for banking customers. Once we set up the generic nature of these touchpoints, we will move ahead with the chatbot build process.

In retail banking, an end customer, usually an entity or individual, deposits savings in a bank, and other entities or individuals borrow that money for other purposes. Apart from that, banks also facilitate online transactions, paying billers, transferring money to other entities, timed deposits, and many other services for retail customers.

Textbook: Abhishek Singh, Karthik Ramasubramanian, Shrey Shivam, “Building an Enterprise Chatbot: Work with Protected Enterprise Data Using Open-Source Frameworks”, ISBN 978-1-4842-5034-1, Apress, 2019

0 Comments